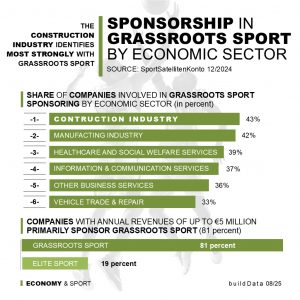

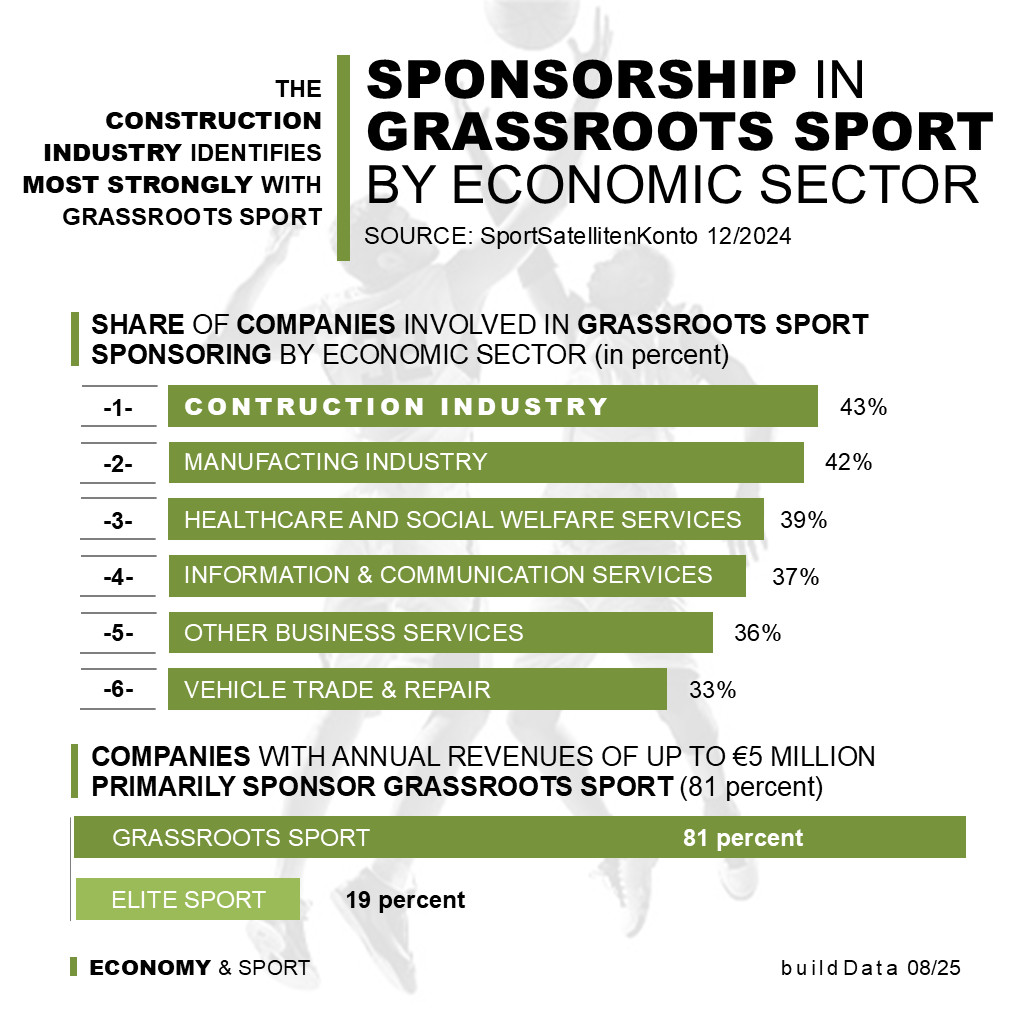

The construction industry is an important partner for amateur grassroots sport

The broad base of companies in the construction industry is mainly involved in sponsoring amateur grassroots sport. Acquiring licences, naming rights or media rights is not important to these companies. For them, the focus is on promoting the sport rather than gaining advertising exposure in return.

More than 4 out of 10 companies from the diverse construction industry sponsor activities in grassroots sport. 81 percent of these companies' sports sponsorship benefits amateur grassroots sport. Interest in professional sports only increases among companies with an annual turnover of more than £5 million.

By far the largest share of sports sponsorship money, 45 percent, goes to amateur sports clubs, 13 percent to sports facilities, 12 percent to professional sports clubs, 11 percent to sporting events, 7 percent to individual amateur athletes and 6 percent to individual professional athletes, 5 percent to sports associations and league organisations, and the remaining 2 percent to other sporting activities.

Grassroots sports clubs without any professional affiliation generate the majority of their annual income from donations. According to information provided by the clubs and an analysis by the German Sport University Cologne, income from donations accounted for around 77 percent of total annual income in 2019 and around 68 percent in 2020 (Covid). Donations are therefore essential for grassroots sports clubs. Sponsorship by companies without the acquisition of licences, naming rights or media rights is classified as a donation in these statistics, together with donations from private individuals.

15 percent of the broad business base in sports sponsorship has no direct connection to sport.

127 of 399 companies involved in sports sponsorship have an annual turnover of over €5 million, 120 between €0.5 and €5 million, and 152 less than €500,000.

Sponsorship funds continue to be unevenly distributed between women's and men's sports. Women's sports account for only 43 percent.

As in the professional sector, football is also the clear focus of sponsorship among the broad business base. Around 31 percent of sponsorship funds go to this sport. Handball accounts for 12 percent, shooting sports for 8 percent and fitness for 6 percent. These are the four largest areas.

29 percent of the companies surveyed stated that their motivation for sponsorship was simply to support sport. However, the main motivations are to improve the company's image (35 percent) and brand awareness (34 percent) and to achieve greater customer loyalty (33 percent). Companies that do not engage in sports sponsorship mainly cite the fact that their budget does not allow for such a commitment.

Sponsorship or donations with the intention of consciously ‘supporting sport’ are therefore not far behind the classic corporate goals of sponsorship. This strengthens the overall system of sport and promotes the breadth of what is on offer, especially in grassroots sport.

When viewed in the context of sport as an overall economic factor, it can initially be noted that the expenditure made directly by companies through sports sponsorship and advertising, including media rights, amounts to approximately €5.5 billion. This is comparatively low when compared to the sports-related expenditure of private households (approximately €82 billion per year) and the investment associated with sports facilities, operating and personnel costs (approx. €27 billion per year).